Medium-Term investment Implications

We expect the Novel Coronavirus crisis will reshape society and the economy in permanent ways, with medium-term implications for investments.

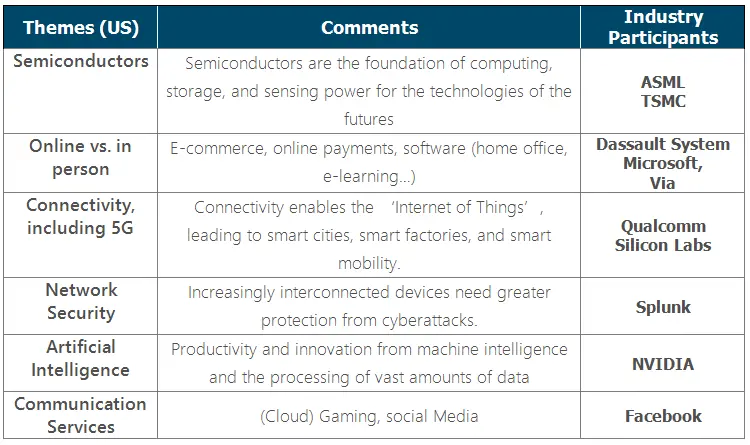

We expect technology to be the greatest obvious beneficiary. Social distancing is the greatest mass product test one could possibly desire. There is nothing like a crisis to focus the mind on the need to increase healthcare spending. “We are at war”, repeated French President Macron several times in one speech. Our third medium-term focus, renewable energy and other sustainable products, are already a growth area, and should continue their trajectory.

We see Technology as the greatest beneficiary of these changes

The SARS outbreak in 2003 was a major boost to the adoption of online shopping and the rise of Alibaba in China. Coronavirus has the potential for more dramatic change in our use of technology. Our new and now almost ubiquitous experiences of tele-commuting for office workers should clearly accelerate the adoption of uses such as homeworking, e-learning, or tele-medicine. Virtual reality – including video -- should permanently gain, relative to pre-Covid usage, at the expense of some amount of physical travelling and gathering. These developments all mean increasing markets for broadband connections, semiconductors, connectivity, software, and social media… and on the other hand, the growth of cybercrime.

If these technologies represent a new step in our way of working and living, their expansion is also a means to help control the epidemic risk beyond this spring and could avoid global containment measures later. The last 20 years provided a few warning signals such as SARS, MERS, and Ebola; the current public health crisis will not be the last one. The rise of new diseases is one of the risks of global warming. The growth of geolocation and smartphone tracking helped authorities in in South Korea, Taiwan and Singapore helped avoid a full containment of the population. In Wuhan, people will progressively return to a “normal life” but likely with smartphone tracking and targeted quarantines.

Naturally this raises questions in some societies. While Big Data, Artificial Intelligence, and geolocation are useful in reducing the economic disruption of controlling the epidemic, might these ‘Big Brother’ method be perceived as a threat to individual privacy?

In the medium term, we expect an upward inflection point in the use of these technologies, especially in the US and emerging markets.

Below and in the following tables, we show examples of companies with significant revenues or profits in the sectors described.

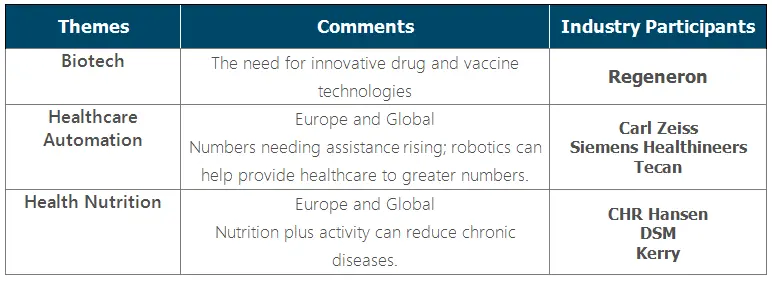

Healthcare will become an even-greater focus for citizens and governments

The Covid crisis is a public health ‘war’, at least as declared by political leaders. If healthcare professionals are the new military, and drugs and vaccines the new weapons, then societies are likely to call for greater budgets. We can expect more government spending on healthcare. Quite possibly, healthcare stocks will face less risk in the US elections; in the months running up to November, anti-spend candidates may have to choose between increased healthcare spending and losing their political races. One must remember this is not just a presidential election; many Congressional seats and state elections are also on the ballots.

We expect the ‘new normal’ – an oxymoron if there ever was one – will be supportive for biotech, healthcare equipment, but also for larger and more diversified pharmaceutical groups.

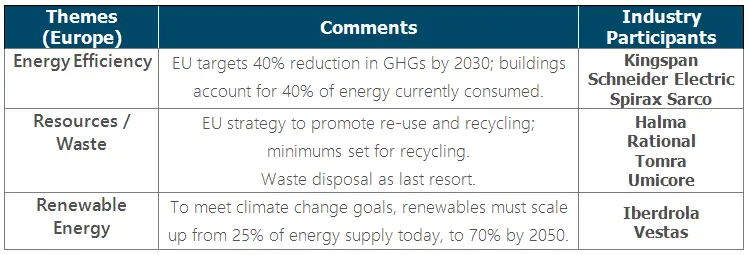

Sustainability and the Environment will continue to take ‘share of mind’

Academics have described environment, sustainability, and social good to be spending for strong economies, often at the top of the cycle. At the risk of mentioning the most dangerous phrase in investing… we think this time is different. We have seen blue skies in China, clean water in Venice, and the rare smogless day in Los Angeles.

Candriam’s 15 years of in-house research shows that there are strong valuation reasons for investing in companies with high ESG ratings (Environmental, Social, and Governance). They tend to be ‘quality growth’ companies in style, rather than ‘value’; we expect quality names to perform in the medium term. Companies which score well on ESG factors also tend to be less indebted, an important positive in the current financial crisis.

With Europe a bit ahead of the curve in pushing environmental regulation, we highlight three themes -- energy efficiency, resources and waste, and renewable energy – each of which benefits from current or proposed government goals, particularly in EU countries. They also have multiple drivers for upside fundamentals. Companies which help corporate and individual consumers use less energy are helping those customers save money, while energy efficiency also helps reduce the reliance of the EU on external oil and gas. Those resource efficiency technologies which are currently profitable have often begun, as many new technologies, with some subsidy, and then taken off once the industry reached a critical scale. Renewables are already benefitting from the faith of ‘early adopters’, and the economics continue to improve.